New Jersey Future Blog

Forum Roundup: Green Bonds: Financing our Future

May 18th, 2016 by Jane Rosenblatt

New Jersey’s future infrastructure, resiliency and housing efforts will need billions of dollars of investment over the coming decades. What financing options do New Jersey and its municipalities have?

Green bonds are a relatively new financing vehicle specifically for projects that are intended to offer environmental benefits as well as a financial return. But green bonds are still an under-utilized tool in New Jersey. A special roundtable discussion at New Jersey Future’s 2016 Redevelopment Forum explored how green bonds can generate a substantial portion of investment needed to fund green projects, including resiliency efforts and infrastructure upgrades, in New Jersey.

The roundtable’s participants, led by Jersey Water Works’ Finance Committee Co-chairmen David Zimmer of the New Jersey Environmental Infrastructure Trust and Chris Daggett of the Geraldine R. Dodge Foundation, included Gov. James Florio of Florio Perrucci Steinhardt & Fader; Caren Franzini of Franzini Consulting; Mike Italiano of Market Transformation to Sustainability (MTS) and Capital Markets Partnership; Jonathan Kaledin of Natural Systems Utilities; Peter Kasabach of New Jersey Future; Anthony Marchetta of The New Jersey Housing and Mortgage Finance Agency; and Adam Zellner of Greener by Design.

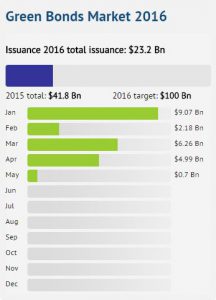

The green bonds market in 2016. Source: Climate Bond Initiative.

In the public sector, bonds are issued by states, counties and local government entities to generate funding for various public projects. A bond is ‘green’ when the issuer states publicly that it is raising capital to fund green projects or activities with an environmental benefit, such as constructing green infrastructure, investing in energy efficiency or sustainable water system management. Green bonds are of particular interest for issuers because they can offer a lower interest rate than typical bonds, bringing down the cost of project financing.

The U.S. Environmental Protection Agency estimates that New Jersey will face a price tag of over $40 billion over the next 20 years to upgrade its water infrastructure. The panel’s participants pointed to DC Water, the water and sewer authority for the District of Columbia, and its successful issue of $350 million in green bonds as an example of how they could be used in New Jersey to raise the funds for water infrastructure investment. The New Jersey Environmental Infrastructure Trust closed on its first green bond last year and provides another good example of how green bonds can be used effectively.

Participants in this year’s roundtable discussion concluded that green bonds should be explored in greater detail to accelerate their use in New Jersey. A good starting point to further this discussion is to work with some of the state agency bond issuers to maximize their potential for saving money and improving their green portfolios and to work with some of the state’s larger bond investors to increase their involvement in this marketplace.

“[Green bonds] are a social phenomenon that is translating to Wall Street.” — Mike Italiano

Additional uses for green bonds in New Jersey could include investment in resiliency projects throughout the state to combat the effects of climate change and the construction of affordable “green” housing that has low environmental impact.

Today, the green bond market is expanding rapidly worldwide, so the participants in the roundtable wondered, “Why aren’t green bonds being used more in New Jersey?” To drive greater utilization, participants identified the need for:

- Standards for what makes a project “green;” the absence of these is an early challenge green bonds face. These standards and metrics for environmental benefit need to be codified to ensure projects that are financed as green indeed have an environmental benefit.

- Data on how how green bonds have been used by other municipal entities.

- Education of local leaders on the financial incentives for using a green bond over a traditional one.

Additionally, the group discussed bringing together bond issuers and buyers to begin educating them on the financial incentives of green bonds and to continue exploring ways New Jersey can take advantage of this new financing option.

The Jersey Water Works Finance Committee is working to identify funding strategies and opportunities to ensure financially sustainable drinking water, wastewater and stormwater infrastructure systems. Its action items for the year are outlined in Jersey Water Works’ 2016 Work Plan.

For more information on green bonds, see these primers from The World Bank and from consulting firm KPMG.